ICE-T Inpatient Cost Evaluation Tool

Risk Mitigation in Bundled Payments

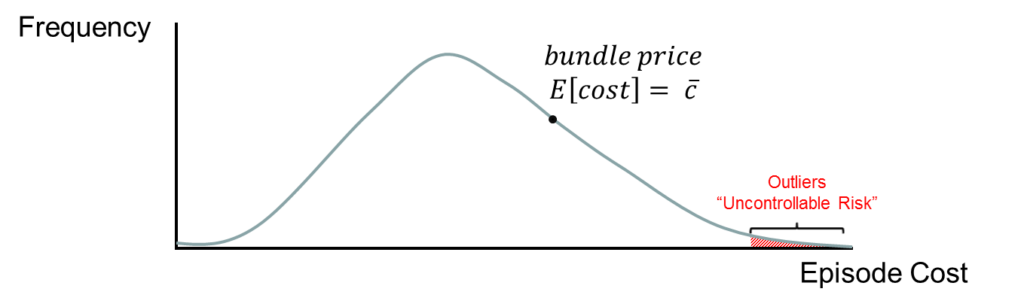

Bundled payments explicitly shift risk to providers to incentivize them to manage costs. However, it is widely agreed that there always exist high costs outside of providers’ control due to risky patients with various comorbidities, condition severity, and other factors. Under fee-for-service (FFS) payments, providers are directly reimbursed for all of the procedures performed, ensuring that they are adequately compensated for the additional work these outlier patients require. However, bundled payment models must handle this risk differently.

Outlier Risk

Under bundled payments, these patient outliers can be thought of as an “uncontrollable risk” that increases the likelihood that a provider’s costs exceed retrospective bundled payment benchmarks. Although an actuarially fair bundled payment covers the cost of these outliers, the benchmarks are usually derived from payer data which contain the entire population of episodes. Individual practices only see a portion of these episodes.

Unless a practice encounters a very large share of the total population of patient episodes, they are highly unlikely to have enough episodes to converge to a benchmark developed strictly from payer data. Moreover, because episode costs are not normally distributed data, and are typically characterized by long right tails of very expensive episodes, practices are likely to draw enough outlier patients for their average episode cost to exceed the annual benchmark. The smaller the practice, the greater the likelihood of exceeding the benchmark.

Thus, it is always important to examine and discuss your practice’s data when entering negotiations for bundled payments!

Risk Mitigation with Retrospective Bundled Payments

Beyond carefully using a practice’s data to negotiate episode benchmarks that are more appropriate for a practice’s population, there are several approaches available to help manage risk in retrospective bundled payment models. As with all retrospective payments, the methods described below require that the FFS claims associated with the episode continue to be filed in order to establish the benchmarks and thresholds required to operationalize these approaches.

Stop-Loss

The most common risk mitigation approach for retrospective bundled payments is the use of a “stop-loss”. Under this approach, a specific stop-loss threshold is designated, such as the top 1% of episodes by cost. If an episode cost falls above that threshold, payers will reimburse providers for the total cost of the episode, instead of the negotiated bundled price.

Negotiated stop-losses prevent providers from being punished with losses for the outliers considered to be out of their control. Some providers negotiate a stop-loss based on 1.5 to 2 standard deviations of the historical episode mean cost, but a more common approach is a 1/99 or 5/95 winsorized stop-loss which also adjusts the reimbursement of very low cost episodes.

Re-Insurance

Practices can seek insurance policies that cover the risk associated with episodes exceeding the benchmark episode cost. The policy reimburses providers for all episode costs above a designated threshold. Insurance premiums generally include the expected payout to providers over time plus the nominal profit the insurer receives for taking this risk. For re-insurance policies to be effective, practices must generate enough savings to offset the insurer’s profit and must generate enough claims above the threshold amount to recoup their premiums.

However, insurers may include providers’ incentive to “up-code” patients to ensure insurance premiums are being recouped into their premiums. Thus, this approach is best used when establishing very high payout thresholds to protect against extreme outlier episodes.

Risk Mitigation with Prospective Bundled Payments

Unlike retrospective bundled payments, prospective bundled payments do not utilize the flows of cost information that is provided through the filing of FFS claims and will require alternative methods of managing risk. The Neiman Institute continues to work in this area and will provide updates on how to best manage risk using prospective bundled payments in the future.